Aetna H5521 plans are the health insurance you can choose to protect and improve your health. Aetna Medicare Premier Plan, a Medicare supplemental insurance, is divided into different types. You can sign up on the Aetna website and contact your health planner to find the plan that’s right for you. You can also get information and sign up for plans by calling 1-888-387-9975 (TTY 711) between 8 AM and 8 PM.

Aetna H5521 Medicare Plans

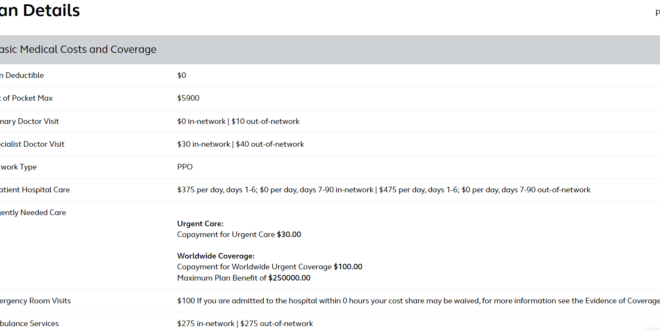

Aetna has several Medicare Premier plans, starting with H5521. These plans vary within themselves. You can enroll in the plan that best suits you, both in terms of funds and opportunities. Changes in plans vary both in-network and out-of-network. Generally, in-network primary doctor visits are $0. For specialist visits, you pay much less. You also pay little for urgent care and do not pay for many of the diagnostic tests performed on you.

In PPO plans, eye, tooth, and ear costs are $0 for annual routine care. These programs also have OTC services, and you receive funds that you can use for over-the-counter medications every 3 months. Detailed information about your allowances that you can use for health and wellness materials is included in the Aetna 2024 catalogue. You can purchase all products in the catalog in unlimited quantities at the specified prices. Additionally, you can also receive all approved products using online ordering.

Aetna H5521 Medicare Plan Benefits

Your Aetna H5521 plans help you pay less for specialist visits. The discounted plan has a PPO network type and in-network primary doctor visits are $0. Inpatient fees are $0 on days 1-6 and are discounted thereafter. Also, if you are someone who travels a lot as it offers worldwide emergency coverage, H5521 plans may be for you. It reduces the costs of healthy living and offers you the chance to be examined by better doctors at an affordable price.

Aetna H5521 801 Plan

Aetna H5521 801 PPO plan allows you to receive in-network treatment at no cost. Since it is a PPO plan, you do not need to get referrals to be examined by specialists. There are many more doctors to choose from compared to other plans. However, when choosing an out-of-network doctor, you must pay some money. These fees are fully discounted. Thus, thanks to the H5521-801 plan, you have the chance to regain your health in a more affordable way.

Aetna H5521 802 Plan

One of the Aetna Medicare Basic Plans, H5521 082, has an initial annual coverage limit of $4,020. With this plan, which has the local PPO variant, you will be out of pocket for a maximum of $6700. It has a 5-stage medication planning, and at each level, pharmacy cost sharing and the number of drugs per level vary. Moreover, you can use the Aetna website to list pharmacies that fit your plan. Your online orders will be delivered to you within 2 business days.

Customer satisfaction of H5521-802 plan, which has a total of 564 members, is quite high. The total monthly premium is $58, with a health plan deductible of up to $1,000. In-network services are very low-priced, and you may have to pay more when getting out-of-network services. Services like in-network preventive care and primary physician visits are also free. You cannot add to the plan because there is no optional additional benefit allowance.

Aetna H5521 120 Plan

The Aetna H5521 120 discount plan is $1000, leaving you with a maximum of $7550 out of pocket. Primary doctor visits are $0 in-network and $50 out-of-network. For specialist doctors, the fee is $35 in-network and $60 out-of-network. Aetna H5521-120, a PPO plan, lets you avoid paying for inpatient hospital care for up to 120 days. You also have worldwide insurance and can receive affordable worldwide healthcare when emergency care is required. You also receive services in areas such as diagnostic tests, laboratory, radiology services, diabetes supplies, chiropractic services, mental health and substance addiction at very affordable prices.

Aetna H5521 293 PPO Plan

The H5521 293 PPO plan, with a discounted plan price of $250 and a maximum out-of-pocket fee of $5500, is a health insurance you can have from Aetna at affordable prices. An out-of-network primary doctor visit is only $10. Additionally, if you want to be examined by specialist doctors, you pay $25 in-network and $50 out-of-network. You can save money on healthcare with this Aetna PPO plan, which offers lower-priced emergency care copays and diagnostic tests.

H5521 243 PPO Plan

One of the most affordable programs offered by Aetna is the H5521 243 plan. This discounted plan is $0, and the maximum out-of-pocket amount is $6800. While in-network physician service is free, out-of-network specialist physician services are $40. While you are hospitalized, you pay nothing for the first 6 days, and for subsequent days you pay $295 in-network and $395 out-of-network. You can call ambulances at affordable prices and be eligible to receive international emergency care service. In addition, some of your additional treatment costs are covered by Aetna.

Aetna PPO H5521 170 Plan

One of the health programs you can choose for your health is Aetna H5521 170. If you choose this program from Aetna, the maximum amount you are expected to leave out of pocket is $4500. In-network primary doctor visits are free, and you pay very little for both in-network and out-of-network specialist visits. Urgent care copay is only $20, and urgent care visits are free if you are hospitalized within 0 hours. Moreover, you can avoid paying extra money for the tests you will have, or you can have your diagnostic tests done at affordable prices. Depending on the situation, you may not pay any fees for inpatient hospital care, nursing facility care, and diabetes supplies.

Aetna PPO Plan H5521 218

The maximum amount due on the H5521 218 PPO basic plan is $5,900. An out-of-network primary doctor visit is $20, and an out-of-network specialist visit is $50. If you stay in hospital, you do not pay any fee for the first 9 days. Since many diagnostic tests are free of charge, you have the opportunity to receive treatment at affordable prices. You can receive urgent care in-network and internationally. You will also be reimbursed for some of your medical equipment. In this way, you can purchase expensive equipment that you need to use for a long time at more affordable prices.

Aetna H5521 086 Plan

The maximum out-of-pocket amount for H5521 086, one of the H5521 PPO plans, is $3950. This fee may be considered low compared to other PPO plans. In-network specialist doctor visits are set at $40 and out-of-network specialist visits are set at $50. Thanks to this application, where you can access all the opportunities of PPO, you can stay in the hospital free of charge for some and pay 300 dollars for the following days.

You can do hospital tests with minimum amounts, as Lab services start from $5, Diagnostic Procedures from $75, and Xray from $15. Additionally, you can take advantage of other health opportunities and use free or low-priced care services. Offering discounts on almost every area you may need; this Aetna PPO plan is a great opportunity for you to get better.

Plan H5521 159 of Aetna

The H5521 159 plan is one of Aetna’s most advantageous health insurance plans. The difference between in-network and out-of-network specialist doctor visits is only $5. Out of pocket max is only $5900. You are entitled to a free hospital stay and must pay $395 for each subsequent day. Ambulance services cost $290 and most diagnostic tests are free. You can get discounts on healthcare equipment, and you’ll pay even more discounted prices in areas such as mental health, substance abuse, and prosthetic devices. You don’t pay for most dental services. You won’t pay for in-network eye exams, eyeglasses, routine hearing tests and hearing aids once a year.

Aetna H5521 091 Plan

Aetna H5521 091 plan offers many health benefits for you. Calculated to cost a maximum of $6,000, you get a 40 percent discount on out-of-network primary and specialty doctors for this plan. If you stay in the hospital for more than 7 days and less than 90 days, you pay $0. You generally don’t pay in-network fees for laboratory tests and other diagnostic services. You get all examinations done outside the network at a discounted rate.

There are also many eye, ear and dental opportunities in the H5521 091 program. You will have a routine examination once a year in all three sections and you can benefit from it free of charge. You can request many procedures performed by doctors free of charge. There is also the chance to have some transactions done at a discounted price. Additionally, you can obtain the medical equipment necessary for eye, ear and dental carefree of charge. This isn’t always the case, and you can only get most equipment for free once a year.

Aetna H5521 272 PPO

One of the most loved PPOs, H5521 272 is one of the important health programs by Aetna. In this program, if you stay in the hospital for 1-6 days, you pay $290 for each day and do not pay for 7-90 days. If out of network, you can get a 50% discount. The maximum amount is determined as 5100 dollars and this includes additional eye, dental and ear examinations. You can benefit from free routine examinations, medical equipment, or equipment replacement, etc., thanks to the H5521 272 plan.

Usalia

Usalia