Embarking on the journey to understand the difference between Medicare Supplement Plans can be daunting, but it’s a vital step for anyone managing their healthcare with Medicare. These strategies play a role, in reducing your costs and guaranteeing extensive protection. Our handbook is design to clarify these choices making it easier for you to make decisions. Whether you’re new to enrollment or reevaluating your existing plan this post is customized for you.

What are Medicare Supplement Plans?

Medicare Supplement Plans, also referred to as Medigap are insurance policies that enhance the coverage provided by Original Medicare. They help cover expenses that are not include in Medicare Parts A and B such, as copayments, coinsurance and deductibles. These plans are an option, for individuals who desire coverage beyond what is offer by basic Medicare.

How Do Medicare Supplement Plans Work?

Medicare Supplement Plans are design to complement your Original Medicare coverage. They come into play once Medicare has covered its portion of the healthcare expenses. These plans assist in controlling, out of pocket costs providing beneficiaries with predictability and manageability when it comes to healthcare expenses.

How Many Medicare Supplement Plans Are There?

There are a total of ten Medicare Supplement Plans that you can choose from, known as Plan A through Plan N. These plans vary in terms of coverage and benefits giving individuals the flexibility to select the one that aligns with their healthcare requirements and financial situation.

What Are the Advantages of Medicare Supplement Plans?

Medicare Supplement Plans offer benefits, such, as, out of pocket expenses, wider healthcare coverage and the flexibility to select any Medicare accepting doctor. These plans bring peace of mind by covering costs that are not include in Medicare.

Are Medicare Supplement Plans Regulated by CMS?

Yes the regulation of Medicare Supplement Plans falls under the responsibility of the Centers, for Medicare & Medicaid Services (CMS). The CMS is responsible for establishing and maintaining standards, for these plans ensuring that they adhere to requirements and offer coverage to those who benefit from them.

Are Medicare Supplement Plans Regulated by the Federal Government?

Yes the federal government regulates Medicare Supplement Plans. This regulation guarantees that all plan types regardless of the insurance provider offer benefits in order to protect consumers interests.

Are Medicare Supplement Plans Worth the Money?

Whether or not Medicare Supplement Plans are a worthwhile investment is contingent upon your healthcare requirements and financial circumstances. They can prove beneficial, for individuals who require attention or desire protection, against unforeseen medical costs.

Are Medicare Supplement Plans HMO or PPO?

Medicare Supplement Plans are not HMOs or PPOs. They belong to a category of insurance policies that complement Original Medicare by offering coverage, for expenses that are not cover by Medicare.

Are Medicare Supplement Plans Tax Deductible?

Medicare Supplement Plan premiums have the potential to be tax deductible. There are conditions that need to be met. If your overall medical expenses, including the premiums, for your Medicare Supplement Plan go beyond a percentage of your adjusted income you might qualify for a tax deduction.

Are Medicare Supplement Plans Standardized?

Indeed Medicare Supplement Plans follow a structure. Regardless of the insurance company offering them each plan type provides advantages. This uniformity simplifies the process of comparing plans, from insurers.

Are Medicare Supplement Plans Free?

Medicare Supplement Plans do not come without a cost. They require a payment, in addition to the premiums, for Medicare Part B. The price of these plans varies depending on the type of plan and the insurance company offering it.

Can Medicare Supplement Plans Deny Coverage?

Medicare Supplement Plans cannot refuse coverage due, to existing conditions if you enroll during your Medigap Open Enrollment Period. However outside of this timeframe insurance providers may assess your eligibility based on underwriting.

Can Medicare Supplement Plans Be Used Out of State?

Yes, you can use Medicare Supplement Plans even if you’re, outside of your home state. These plans offer coverage across the country giving you the freedom to see any doctor or visit any hospital that accepts Medicare, no matter where you are, in the United States.

Can Medicare Supplement Plans Be Primary?

Medicare Supplement Plans cannot act as the insurance coverage. Their purpose is to provide support to Original Medicare, which continues to serve as the insurance, for healthcare services that are covered.

When Can Medicare Supplement Plans Be Purchased?

You have the option to buy Medicare Supplement Plans during the Medigap Open Enrollment Period, which starts on the day of the month when you reach 65 and are already enroll in Medicare Part B. This specific period lasts for a duration of six months.

When Can Medicare Supplement Plans Be Changed?

You have the flexibility to switch Medicare Supplement Plans whenever you like. Its generally recommended to do during the Medigap Open Enrollment Period. If you decide to make changes outside of this period there is a chance that you may undergo underwriting, which could potentially result in denial of coverage or higher premiums being charge.

When Did Medicare Supplement Plans Start?

Medicare Supplement Plans were introduced in 1966 not long after Medicare was establish. Their purpose was to assist beneficiaries in managing the expenses that come with Medicare covered services.

Do Medicare Supplement Plans Have Networks?

Medicare Supplement Plans offer you the freedom to choose any doctor or hospital that accepts Medicare. This flexibility is one of the advantages of these plans as it allows you to have access, to a range of healthcare providers without being limit by networks.

Do Medicare Supplement Plans Cover Dental?

In cases dental care is not cover by Medicare Supplement Plans. Original Medicare or Medigap policies usually do not include coverage so you might need to consider getting dental insurance.

Do Medicare Supplement Plans Cover Prescription Drugs?

Medicare Supplement Plans do not include coverage, for prescription medications. If you require prescription drug coverage you will need to enroll in a Medicare Part D plan or consider a Medicare Advantage plan that provides this coverage.

Do Medicare Supplement Plans Automatically Renew?

Yes, Medicare Supplement Plans will renew automatically every year long as you keep paying the premiums. This guarantees coverage eliminating the requirement to reapply on a basis.

Do Medicare Supplement Plans Cover International Travel?

Certain Medicare Supplement Plans provide coverage, for emergency services while traveling internationally. However the extent of this benefit may differ depending on the plan you have. It is crucial to review the details of your plan to understand its coverage, in situations.

Do Medicare Supplement Plans Require Prior Authorization?

Medicare Supplement Plans generally do not need approval, for services. They align with Medicares guidelines so if Medicare gives the light for a service the supplement plan usually covers its portion without any authorization.

Do Medicare Supplement Plans Cover Pre-existing Conditions?

Medicare Supplement Plans provide coverage for existing conditions if you enroll during your Medigap Open Enrollment Period. However if you enroll outside of this period the coverage, for existing conditions may be subject, to delay or denial based on medical underwriting.

Does Medicare Supplement Plans Cover Hospice?

Medicare Supplement Plans assist with the expenses related to hospice care that Medicare Part A doesn’t fully cover. These plans encompass copayments and coinsurance offering assistance during hospice care.

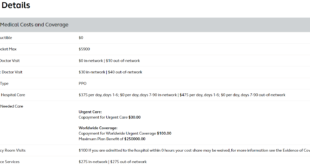

How Much Do Medicare Supplement Plans Cost?

The prices of Medicare Supplement Plans can differ depending on factors such, as the type of plan, where you live your age and the insurance company that provides the plan. It’s crucial to compare options since prices can vary greatly.

Does Anthem Have Medicare Supplement Plans?

Anthem provides Medicare Supplement Plans, in states. These plans are specifically created to complement Original Medicare and offer coverage for expenses that are not covered by Medicare ensuring that you have protection, for out of pocket costs.

Does Kaiser Have Medicare Supplement Plans?

Kaiser Permanente provides Medicare Supplement Plans, in areas. These plans are designed to enhance their Medicare Advantage offerings giving beneficiaries coverage choices.

Does UPMC Have Medicare Supplement Plans?

UPMC provides Medicare Supplement Plans that offer coverage to assist with the expenses that Original Medicare does not cover. These plans are included in UPMCs selection of products related to Medicare.

Does WellCare Have Medicare Supplement Plans?

WellCare offers Medicare Supplement Plans, in regions. These plans are specifically designed to assist individuals by filling in the coverage gaps of Original Medicare thereby reducing the amount they have to pay out of pocket.

Does Aetna Have Medicare Supplement Plans?

Aetna provides options, for Medicare Supplement Plans. These plans are designed to assist with expenses that aren’t covered by Original Medicare, such, as copayments, coinsurance and deductibles.

Does United Healthcare Have Medicare Supplement Plans?

United Healthcare provides Medicare Supplement Plans, under the AARP label. These plans are well liked by individuals who have Medicare and want coverage to enhance their existing Original Medicare benefits.

Does Humana Have Medicare Supplement Plans?

Humana offers Medicare Supplement Plans, in areas. These plans are specifically designed to assist with covering healthcare expenses that are not included in Original Medicare.

Does FEHB Have Medicare Supplement Plans?

The FEHB Program doesn’t specifically provide Medicare Supplement Plans. Its plans can be coordinated with Medicare to offer coverage, for retired federal employees.

Does Cigna Have Medicare Supplement Plans?

Cigna provides Medicare Supplement Plans, in states. These plans are designed to assist in covering expenses that are not covered by Medicare for the services provided.

How to Change Medicare Supplement Plans?

To switch your Medicare Supplement Plans you need to assess and compare the plans that’re available. Take into account your healthcare requirements. Then reach out to the provider of the new plan to enroll. Additionally it’s important to be mindful of underwriting considerations outside of the Medigap Open Enrollment Period.

How to Enroll in Medicare Supplement Plans?

To sign up for Medicare Supplement Plans the first step is to make sure you’re already enrolled in Medicare Part A and B. After that you can select a plan that suits your requirements and financial situation. Finally reach out to the insurance company to finalize the enrollment process.

How Can I Compare Medicare Supplement Plans?

When comparing Medicare Supplement Plans it’s important to consider the benefits provided by each plan the cost of premiums and the reputation and customer service of the insurance provider. Utilizing comparison tools and seeking advice, from a Medicare specialist can also provide assistance, in making an informed decision.

What Medicare Supplement Plans Cover Dialysis?

All Medicare Supplement Plans provide coverage for the coinsurance and copayments related to dialysis, which are not fully covered by Original Medicare. This coverage helps alleviate the burden of dialysis treatment by reducing, out of pocket expenses.

Which Medicare Supplement Plans Cover Part D Benefits?

Medicare Supplement Plans do not provide coverage for Part D benefits. If you require prescription drug coverage you will need to enroll in a Medicare Part D plan or opt for a Medicare Advantage plan that includes drug coverage.

Do Medicare Supplement Plans Increase With Age?

Certain Medicare Supplement Plans have premiums that go up as you get older. These plans are referred to as “attained age rated” plans. It’s crucial to consider how premiums might change over time when deciding on a plan.

Difference Between Medicare Supplement Plans

The difference between Medicare Supplement Plans lies in their coverage and cost. Each plan provides a set of advantages giving beneficiaries the freedom to select a plan that aligns with their healthcare requirements and financial situation.

What Is the Difference Between Medicare Supplement Plans?

The difference between Medicare Supplement Plans is primarily in the specific benefits they offer. Different plans have varying levels of out of pocket costs and the premiums can differ greatly between these plans.

Difference Between Medicare Supplement Plans and Advantage Plans

The difference between Medicare Supplement Plans and Medicare Advantage Plans is significant. Supplemental plans complement Original Medicare by filling in the coverage gaps whereas Advantage plans serve as an alternative, to Original Medicare and often offer benefits such, as prescription drug coverage.

Difference Between Medicare Supplement Plans and Medicare Advantage Plans

The key difference between Medicare Supplement Plans and Medicare Advantage Plans is their structure and coverage. Supplement plans are designed to cover the areas that Original Medicare may not while Advantage plans offer an alternative that often comes with benefits.

What’s the Difference Between Medicare Supplement and Medigap?

Medicare Supplement and Medigap are essentially the thing. People often use these terms interchangeably to refer to insurance plans that fill in the gaps left by Original Medicare coverage.

Final Thought

To wrap up, grasping the difference between Medicare Supplement Plans is a crucial aspect of managing your healthcare effectively with Medicare. Each plan provides advantages, designed to meet healthcare needs and financial constraints.

We trust that this guide has shed light on these distinctions helping you make a decision that aligns with your health and financial preferences. Keep in mind selecting the appropriate Medicare Supplement Plan can greatly improve your healthcare journey and provide you with peace of mind.

Usalia

Usalia