The IRS or Internal Revenue Service is famous, for having a range of forms each designed for financial scenarios and transactions. One such form is the IRS Form 8282 which tends to catch peoples attention due, to its requirements and purpose. This detailed guide seeks to clarify the purpose and importance of this form as the responsibilities it entails for both donors and recipient organizations.

What is Form 8282?

IRS Form 8282 serves as a tool, for reporting purposes. Non profit organizations use this form to communicate with both the IRS and donors regarding the handling of deduction properties. It is required that any changes in the status of the donated property, such as selling, exchanging, consuming or altering it in any way must be carried out within a 3 year timeframe, from the donation.

What is the purpose of IRS Form 8282?

The IRS like any government organization places a strong emphasis, on transparency and accountability.

- The purpose of the IRS Form 8282 is to establish a system that tracks and reports donations those of significant value.

- This becomes particularly important when the donated property exceeds $5,000, in claimed value excluding money or traded securities.

- By maintaining a record of these transactions the IRS ensures that both donors and recipient organizations comply with tax regulations and that charitable contributions are utilized appropriately.

Who must file IRS Form 8282?

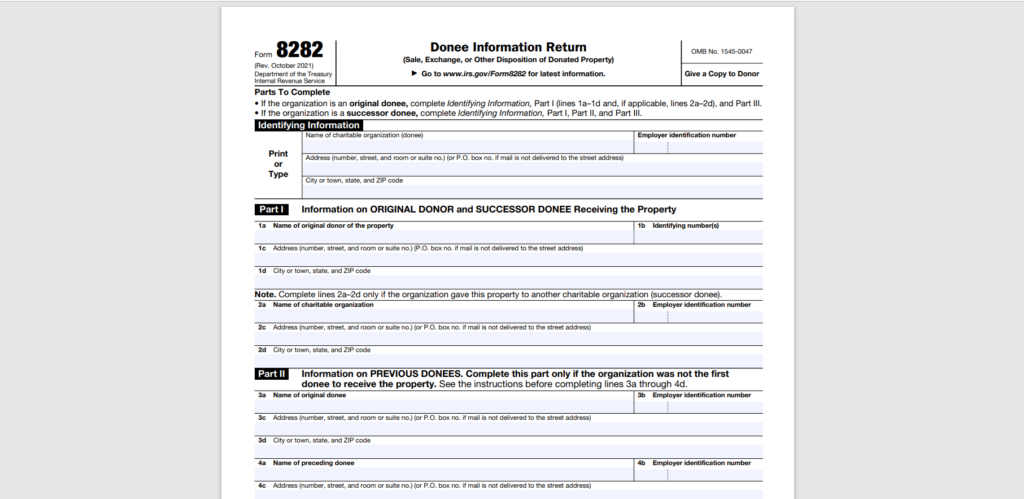

Both the initial recipient and the subsequent beneficiary organizations are require to submit IRS Form 8282 if they engage in the sale, exchange, consumption or any other form of disposal of deduction property within three years from the date when the original recipient received the property.

Do Donors Need To Do Anything With Form 8282?

While donors may not be the ones directly task with completing IRS Form 8282 it’s important for them to have knowledge of its existence. This form plays a role, in ensuring that their substantial charitable contributions are properly record and reported by the organizations receiving them.

Where can I Find A Copy Of IRS Form 8282?

If you’re interested, in obtaining IRS Form 8282 you can find it on the IRS website. They have made both printable and fillable versions available, for your convenience.

Is there a Digital Version Of IRS Form 8282 available?

Sure! In todays era the IRS has made sure that IRS Form 8282 can be easily access online. You can find a version that you can fill out directly on their website, which makes things more convenient, for organizations receiving donations.

What’s The Difference Between Form 8282 and 8283?

Both forms have a connection, to donations. They have distinct functions. Form 8282 is used for reporting the transfer or sale of assets whereas Form 8283 focuses on noncash contributions made by donors.

How often do I Need To Submit Form 8282?

IRS Form 8282 is based on events, than how often they occur. It is require when a charitable organization sells or disposes of a property that previously claimed as a deduction, within three years of acquiring it.

Where can I Get Help if I’m Unsure About How To Fill Out IRS Form 8282?

If you have any doubts or questions regarding any part of Form 8282 you can find instructions, on the IRS website. Moreover seeking assistance, from a tax professional or an accountant can help bring clarity and provide guidance.

Who Should Be Concerned About Filing Form 8282?

If you have any affiliation, with an organization whether as the entity or a successor it’s important to be aware of Form 8282.

This form is necessary if your organization has disposed of property that was eligible for deductions, within three years of receiving it. It’s crucial to understand the details involved. For example if the property sold, exchanged or used up it falls within the scope of this form.

How do IRS Form 8282 and 8283 intersect?

- Forms and their numbers can be quite perplexing especially when they appear related.

- There is often mention of Form 8282 and Form 8283 together which can lead to some confusion.

- To clarify IRS Form 8282 pertains to the reporting of the disposal of properties whereas Form 8283 focuses on charitable contributions made by donors.

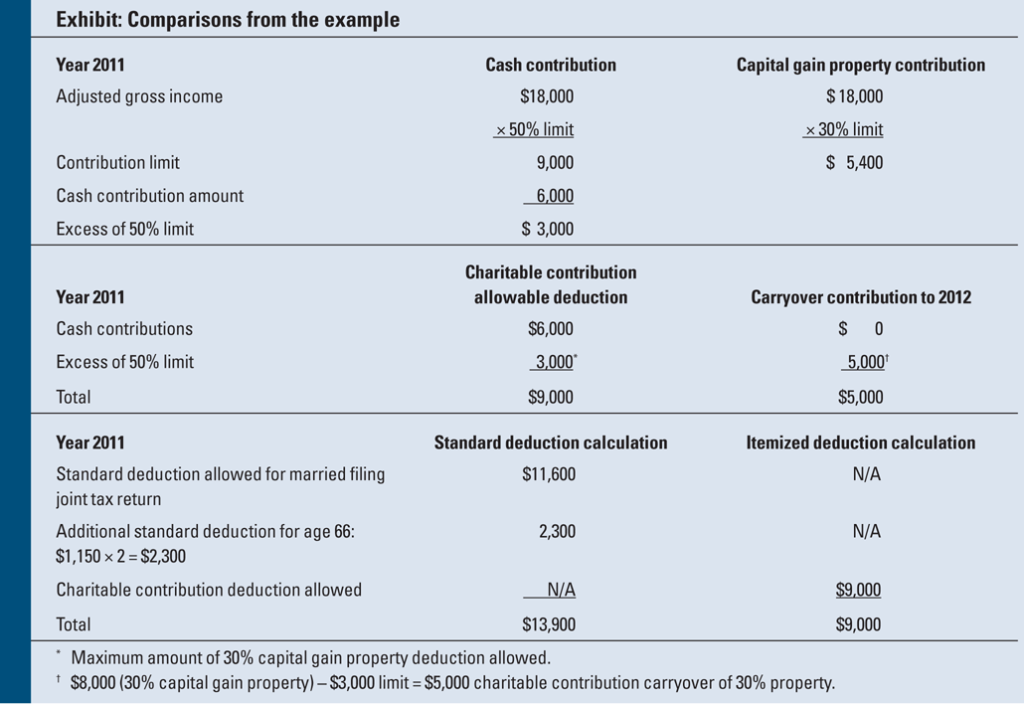

- If a donor is claiming a deduction, for a property donation value, over $5,000 it is require for the recipient to sign Section B of Form 8283.

- This signature serves as an acknowledgement of the donation.

IRS Tax Form 8283 Instructions

Form 8283 known as “Noncash Charitable Contributions ” plays a role, for individuals who generously donate noncash items of value. When the value of a donated property exceeds $5,000 it becomes imperative to complete Form 8283. This form allows donors to provide information about the type of property being donated its value and the methods used for valuation.

The recipient organization responsible for handling the donation acknowledges its receipt, by signing Section B. This signature serves as validation ensuring that both parties comply with IRS regulations and maintain transparency in their contributions.

IRS Form 8282 Fillable

In todays age convenience is paramount. To cater to this need the IRS provides an IRS Form 8282 on their official website. This electronic version allows organizations to input information seamlessly minimizing the chances of errors.

By going digital the form ensures submissions. Eliminates the need, for manual paperwork. As a result organizations can swiftly. Submit the form streamlining the reporting process. This exemplifies the IRSs dedication to keeping up with modernization trends.

When is Form 8282 Required?

It’s important to have a grasp, on when Form 8282 becomes necessary. This form is required when a charitable organization gets rid of property that was eligible for a tax deduction within three years of receiving it.

Getting rid of the property can include selling, exchanging or making changes to it. However there are exceptions, to this rule. If the items are valued at $500 or less then the form is not required.

Similarly if the properties are used up or distributed for reasons then there might not be a need to fill out the form. It’s crucial for organizations to understand these intricacies in order to stay compliant with regulations.

Additional Insights on IRS Tax Form 8283

To better comprehend Form 8282 it is important to familiarize oneself with Form 8283 as they are closely related. Form 8283 also known as “Noncash Charitable Contributions ” is used by donors to document noncash donations. This form becomes particularly relevant when the donated propertys value exceeds $5,000.

The Broader Implications of IRS Form 8282

Apart, from the gritty and the administrative steps it’s crucial to understand the impact of IRS Form 8282. This form emphasizes the significance of openness, responsibility and compliance, with regulations when it comes to donations.

The IRS aims to create a scenario where substantial contributions are monitored and documented ultimately leading to a society that truly benefits from these acts.

Final Thought

Although IRS Form 8282 may appear to be a formality it holds importance within the broader context of charitable contributions and tax regulations. It is advisable, for both donors and recipient organizations to become acquainted with this form as it ensures compliance and promotes contributions, to the community.

Usalia

Usalia